By: Carlos Garcia

The healthcare open enrollment period is in full effect and Hispanics in the United States are still disproportionately uninsured. It’s time we reimagine how we close the Hispanic healthcare coverage gap through enhanced cultural and linguistic understanding.

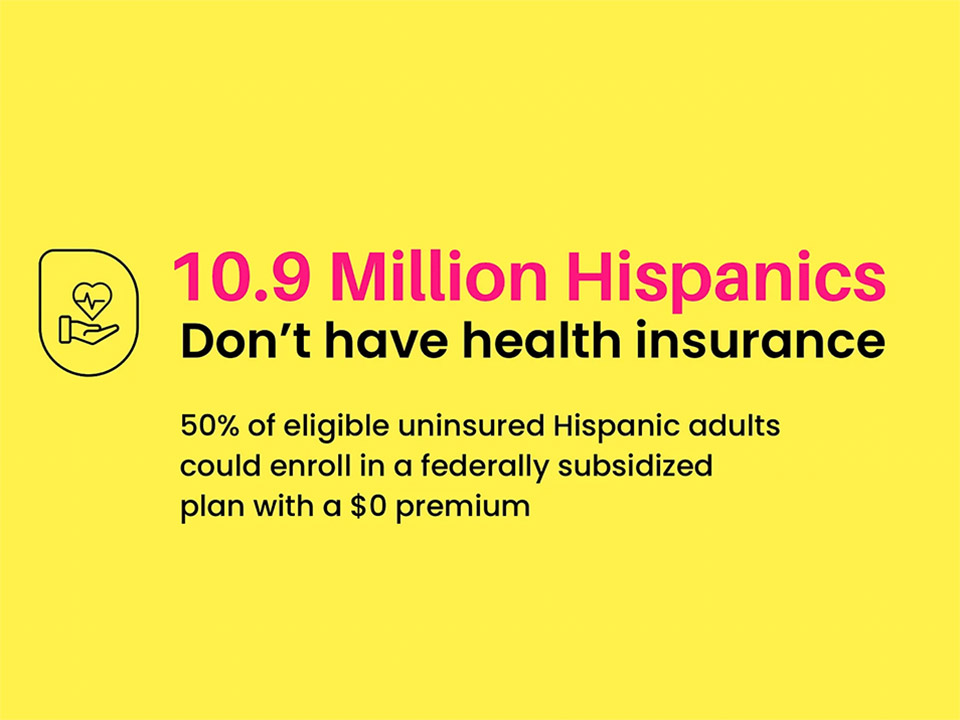

Despite making up nearly 19% of the United States population and being the largest minority ethnicity group in the country, there are 10.9 million uninsured non-elderly Hispanics and they account for nearly 30% of the uninsured population. According to the same report, half of eligible uninsured Hispanic adults can find a zero-premium plan. The options are there, but Hispanics are not getting them. We need to better reach Hispanics in the United States and continue to reduce how many are uninsured.

In past years, legislation like the Affordable Care Act (ACA) and social impact initiatives from private insurance companies have helped close the healthcare coverage gap amongst Hispanics. Yet, while strides have undeniably been made, large gaps remain in nearly every state. For many Hispanics, having knowledge about current health care coverage options remain inaccessible and unaffordable. 63% of Hispanics say they would be unable to pay for an unexpected $1,000 medical bill within 30 days. And regardless of the Biden-Harris administration’s recent extension of premium subsidies through 2025 and federal financial assistance from the ACA marketplace, Hispanic consumers simply don’t know about their options or how to obtain them.

Other factors are still in play that leave Hispanics behind when it comes to knowing and accessing healthcare solutions. As the Hispanic population in the United States continues to grow expeditiously, it is crucial to know how the factors of culture and language contribute to disparate health outcomes for Hispanic Americans. The key opportunity gap I’ve identified from existing health care stakeholders is an underlying deficiency in understanding Hispanic consumer culture and language. Solving this problem requires cultural and linguistic competence from the marketplace and dominant financial institutions. By knowing how to reach and engage Hispanic consumers, we can build trust and close the health care coverage even more. With our society further diversifying, this has never been more important.

A 2020 report found that nearly 70% of Hispanics find health care in the United States overwhelming and 46% believe there are not enough health care resources for their community. And nearly 28% of Hispanics speak limited or no English. As such, Hispanics with language barriers or limited English proficiency (LEP) have fewer physician visits and receive less preventative services such as health care coverage. Reducing these cultural and linguistic barriers can help narrow these healthcare coverage disparities. But in order for this to be achieved, the current marketplace and private insurance companies need to curtail their outreach by becoming more understanding of how to reach the community.

When I started Finhabits, I sought out to tear down these same barriers and teach Hispanics how to better invest financially in themselves. Now, I see a paramount opportunity for Hispanics to maximize their health and healthcare options. At Finhabits, we pride ourselves in knowing how to understand and engage with Hispanics in the United States.

To eliminate remaining health care disparities in the Hispanic community, the current healthcare marketplace and private companies alike should take note of our company’s unique approach: intentionally understanding a community’s language and culture. Through growing our cultural and linguistic competency, we can maximize access to healthcare insurance and help a community that is oftentimes misunderstood and forgotten.