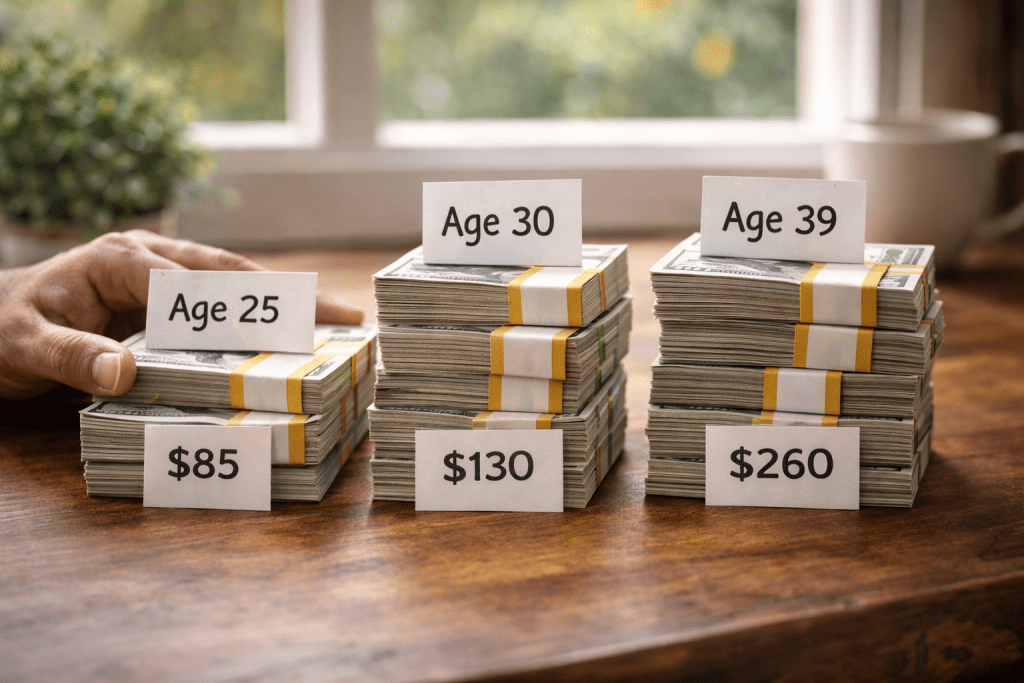

How much to save to retire with $1 million depends mostly on when you start. For example, if you’re 25, you might aim for roughly $85–$90 per week. If you’re 39, you may need closer to $255–$265 per week—assuming long-term returns of about 7% compounded over time and consistent investing until age 65*.

To retire with $1,000,000 by age 65, someone under 40 might invest anywhere from about $85 to $265 per week, depending on their current age, assuming long-term returns of around 7% compounded*. The sooner you start, the less each weekly deposit has to be.

At a glance

- How much to save to retire with $1 million depends heavily on your current age and when you start investing.

- If you are under 40, you may need anywhere from around $85 to $265 per week.

- Assuming a long-term 7% annual return* and automating weekly deposits into a diversified retirement account can help keep your plan on track.

The difference between retiring comfortably and working until you physically can’t isn’t luck or genius; it’s math you’re either ignoring or addressing. Every year you delay starting costs you not just time, but higher weekly contributions you’ll need later to reach the same goal.

At 25, you need about $380 monthly to potentially reach $1,000,000 by age 65. By 39, that number rises to roughly $1,130. Those aren’t abstract calculations; they’re the real cost of postponement—compounding against you with the same mathematical certainty that could be working in your favor.

This guide translates that million-dollar retirement target into the only number that actually matters: what you need to set aside this week, based on your current age, to stop hoping retirement works out and start ensuring it does.

Why this weekly number matters

Without a specific weekly target, retirement planning becomes an endless loop of good intentions that never translate into actual progress. You tell yourself you’ll save “more” next month, next year, after the next raise; meanwhile, the required amount keeps climbing and the window keeps shrinking.

Knowing your weekly target—and what it could potentially grow into over time*—transforms vague anxiety into a concrete problem you can solve: finding the money in your budget, automating the transfer, and moving on with your life.

How the $1 million goal works

A million dollars isn’t an arbitrary number pulled from retirement commercials; it’s grounded in the 4% withdrawal rule that financial planners have relied on for decades. The math is straightforward: if you want to withdraw $40,000 annually from your portfolio without depleting it too quickly, you multiply that by 25 to get $1,000,000. This gives you a sustainable income stream that can better absorb inflation and market volatility over a typical 30-year retirement.

What makes this achievable isn’t exceptional investment skill but the relentless mathematics of compound returns*. Your money earns returns, those returns earn their own returns, and over decades this creates an exponential curve that does most of the heavy lifting.

The 7% annual return assumption* isn’t pulled from thin air; it reflects the historical long-term performance of diversified stock and bond portfolios, though actual returns will vary year by year and nothing is guaranteed.

Weekly savings targets by age (if you’re under 40)

The brutal truth about retirement savings is that procrastination has a precise price tag. Every few years you wait can add meaningfully to the weekly amount you’ll need to invest. The person who starts at 25 can contribute far less each week than someone who waits until the end of their 30s—same destination, drastically different ticket prices.

Here are approximate weekly and monthly targets for people under 40 who want to reach $1,000,000 by age 65, assuming a 7% average annual return compounded over time*.

| Current Age | Years to 65 | Approx. Weekly Amount (7%*) | Approx. Monthly Amount (7%*) |

| 25 | 40 | $85–$90 | $370–$390 |

| 30 | 35 | $125–$130 | $540–$560 |

| 35 | 30 | $185–$190 | $800–$830 |

| 39 | 26 | $255–$265 | $1,100–$1,150 |

*These projections are for educational purposes only and are based on the assumptions shown. Results will vary and may be higher or lower. These examples do not reflect the actual performance of any Finhabits portfolio. Investing involves risk, including the possible loss of principal.

Consider what these numbers actually mean. If you’re 30, starting from zero with 35 years ahead, investing about $125–$130 weekly (roughly $540–$560 monthly) into a diversified portfolio averaging 7% annually* puts you on track for about $1,000,000 by 65. That’s a few everyday expenses traded for potential financial independence.

As you move through your 30s, the required weekly amount climbs quickly—not because the goal changed, but because time did. The earlier you build the habit and automate it, the more compounding does the heavy lifting for you.

What to do with your number

Knowing your weekly target solves exactly half the problem. The other half is engineering your life so that money moves automatically, without relying on willpower or memory.

If you’re paid biweekly, double your weekly target and schedule that transfer to hit your retirement account the day after your paycheck lands. Weekly target of $130 becomes $260 every two weeks; set it once and let the system run.

The account type matters less than actually starting, but the tax advantages of IRAs make them the logical first choice. Traditional IRAs may give you a tax benefit now, and you generally pay taxes later when you withdraw. Roth IRAs work in reverse: you pay taxes on contributions today, but qualified withdrawals in retirement can come out tax-free. Individual situations vary, so consider talking to a tax professional about what fits your needs.

Finhabits streamlines this entire process: you can open an IRA, select a diversified portfolio matched to your timeline, and automate contributions based on these age-specific targets. The automation is crucial; manual transfers rely on discipline that most people don’t maintain over decades.

How to stay on track over time

Your initial weekly number is a starting point, not a permanent fixture. Life changes, incomes rise, expenses shift, priorities evolve. An annual review helps keep your retirement plan aligned with reality rather than the circumstances you had when you started.

After each raise, before lifestyle inflation absorbs the extra income, increase your automated contribution by at least half the raise amount. This adjustment can materially improve your long-term outcomes without requiring a painful lifestyle change.

Diversification isn’t about being fancy; it’s about not betting your entire future on any single company or sector*. A properly diversified portfolio spreads risk across hundreds or thousands of investments, smoothing out the inevitable ups and downs of individual stocks.

As markets move, your allocation drifts from its target. Periodically rebalancing helps keep your risk level aligned with your time horizon and goals*.

Common traps to avoid

Three specific behaviors derail more retirement plans than market crashes ever will. Recognizing them early lets you build safeguards rather than learning these lessons the expensive way.

Waiting for “extra” money. There’s never extra money; there are only priorities. Starting with a smaller amount and increasing gradually builds the habit and captures years of compounding. Waiting for the perfect amount means watching your required contribution rise while you deliberate.

Stopping during market drops. The urge to pause contributions when markets fall is exactly backward. Down periods can be the best times to keep investing because your regular contribution buys more shares. Historically, markets have recovered over time, but outcomes are never guaranteed*.

Parking everything in cash. Cash feels safe because the number doesn’t go down, but inflation silently erodes its purchasing power. A million-dollar goal typically requires growth that can outpace inflation over decades, which is why many long-term investors use diversified portfolios rather than keeping all savings in cash*.

Bringing the $1 million goal down to earth

The path to a million-dollar retirement isn’t mysterious or complex; it’s a mathematical process that rewards those who start and punishes those who wait. Your age determines the price of admission: roughly $90 weekly at 25, around $130 at 30, about $190 at 35, or roughly $260 at 39.

Find your number in the table above. Open a retirement account this week, not next month, not after you “figure things out.” Set up the automatic transfer for the amount you can manage today, even if it’s half your target. Schedule a calendar reminder for one year from now to increase it. Then stop thinking about it and let compound returns* do what they’ve done for patient investors over time: transform small, consistent contributions into long-term financial security.

Sources

- Internal Revenue Service (IRS) – Traditional and Roth IRAs

- Internal Revenue Service (IRS) – IRA Contribution Limits

- Investor.gov (U.S. Securities and Exchange Commission) – Compound Interest Calculator

- Investor.gov (U.S. Securities and Exchange Commission) – Diversify Your Investments

- Investor.gov (U.S. Securities and Exchange Commission) – Asset Allocation, Diversification, and Rebalancing 101

- Securities Investor Protection Corporation (SIPC) – What SIPC Protects

- Investopedia — What Is the Average Annual Return of the S&P

- NYU Stern (Aswath Damodaran) — Historical Returns on Stocks, Bonds and Bills: 1928-2024

- YCharts — S&P 500 Annual Total Return (Yearly)

- Reuters — S&P 500 correction in six charts

- FInhabits — Compound Interest Calculator

All sources accessed and verified on December 26, 2025. External links open in new window.

Disclaimer:

This material is provided for informational purposes only and is not intended to offer investment, legal, or tax advice. All images and figures are for illustrative purposes. Investment advisory services are offered through Finhabits Advisors LLC, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. Past performance is not indicative of future returns. All investments involve risk, including the possible loss of principal. Securities are offered through Apex Clearing Corporation, Member of FINRA, SIPC. Securities held at Apex are protected up to $500,000, which includes a $250,000 cash limit. See SIPC.org for more details.

Projections are for educational and illustrative purposes only. They are based on the assumptions stated and will change if those assumptions change. They do not predict or reflect the actual performance of any Finhabits portfolio, and they do not account for economic, market, or individual financial factors that can impact real investment outcomes.

© Finhabits, Inc. All rights reserved.