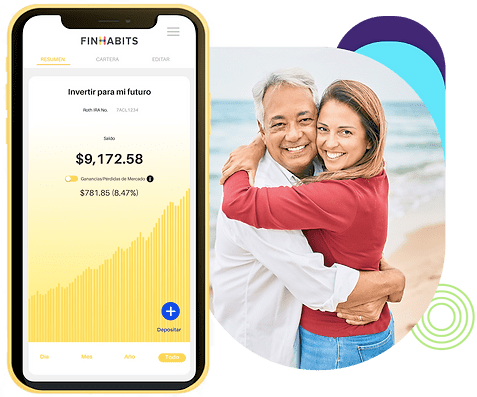

Investing for Retirement Made Easy

- Start in just minutes

- Automate deposits that can be paused

- Leverage potential tax benefits

- Get a diversified ETF portfolio

What is an IRA?

You don’t need to be an expert to invest your money successfully. Finhabits does that for you.

Traditional IRA vs Roth IRA

Security is

everything

There’s nothing more important to us than keeping your money and personal information safe and sound.

Finhabits is an SEC-registered investment advisor. With Finhabits, you can count on bank-level security that includes a 265-bit SSL-encrypted connection on our site.

And you can rest easy, since your money is held in accounts insured up to $500,000 by SIPC.

Expert investment portfolios

Finhabits uses exchange-traded funds. These ETFs include hundreds of companies like Tesla, Amazon, and Disney.

Finhabits diversify your portfolio investing in ETFs that include:

- U.S. stocks

- International stocks

- Government bonds

- Corporate bonds

- Real Estate Investment Trusts (REITs)

How much does Finhabits cost?

We invest your money in low-cost index funds managed by BlackRock, Vanguard, and Goldman Sachs. These funds incur on average a fee of 0.12% per year, which is charged in addition to the fee you pay Finhabits. Additional custodian charges that are not part of the normal service may also be incurred. Please review our ADV Part 2 for more details.

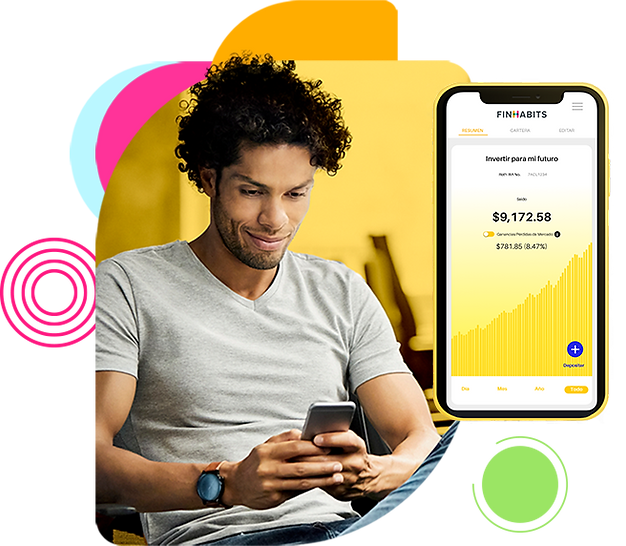

How can you start investing?

1

Finhabits app

2

SSN or ITIN

3

deposits

Accounts

deposits

reinvestment

rebalancing

and podcasts

& Support

Frequently asked questions

There is no minimum initial deposit required to open a Finhabits IRA.

Yes, Finhabits allows you to withdraw your IRA money at any time. Keep in mind that the IRS may impose an early withdrawal penalty before the age of 59 ½ with the intention of encouraging you to save long-term. Under some special, qualified exceptions, you can withdraw money from your IRA without penalty. Rules vary depending on the type of IRA you have. Roth IRA allows you to withdraw your contributions at any time without any penalty or federal tax if you have met the 5-year account requirement. Other rules apply. Please consult with a tax expert for more details.

Yes, please contact the Finhabits support team and they'll guide you. Call 1-800-492-1175 or send an email to support@finhabits.com.

Invest your money with a real strategy

Take the first step today. ¡Sin compromisos!