Grow your wealth automatically with expert-built portfolios

Finhabits members invest with confidence through automated deposits, smart rebalancing, and low-cost ETFs

As seen in

How it works

Become a member

Join Finhabits, members get 3 investment accounts

Deposit automatically

Set it and forget it so you don’t miss out when life gets busy

Grow your wealth

Your portfolio is rebalanced, reinvested, and diversified for you

Your Finhabits membership includes the account types you need to reach your goals

Flexible investing for any goal

The Personal Investment account is perfect for medium- and long-term goals like buying a home or simply building wealth.

A safety net you can count on

This account is ideal for building a financial cushion so that you and your family are prepared for unexpected expenses. The Emergency Reserve Account is designed to minimize the risk of loss.

Tax-advantaged retirement investing

Individual retirement accounts (IRAs) help you build wealth and invest for retirement while taking advantage of tax benefits - an essential step toward a secure retirement.

Withdrawals are allowed starting at age 59½. Taking funds out earlier may result in IRS penalties and taxes. Traditional and Roth IRAs available.

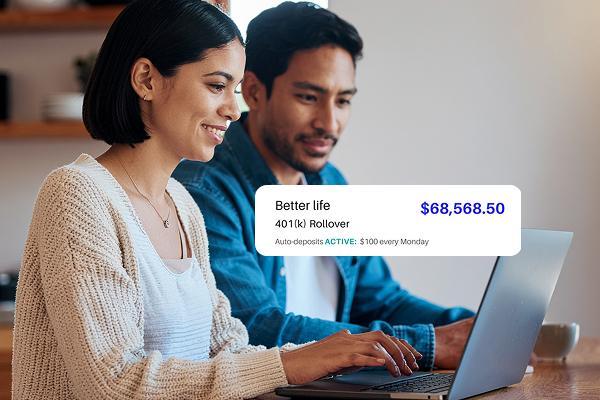

We help with 401k rollovers and IRA transfers

Simplify your finances by moving retirement savings into one professionally managed account.You can roll over one or more accounts.

Complete a 401k rollover when you switch jobs or when you have multiple retirement savings accounts (401ks or IRAs) and want to consolidate them.

We’ve helped over 900,000 people learn better financial habits. Our clients have invested more than $400 million at Finhabits. We’re excited to help you too!

4.6

App Store rating

"Finhabits is a way to grow your money, a way to learn how to invest your money."

Myriam C.

“Go for it, you won’t be disappointed with Finhabits. That would be my message.”

José P.

“You can achieve your goals as long as you start building the habit of saving — the sooner you begin, the more likely you are to reach your objective.”

Olga G.

The testimonials presented are from individuals who were Finhabits users at the time they shared their comments. They were not compensated for their opinions. The experiences described do not necessarily reflect those of all users and are not a guarantee of future results.

Why invest at Finhabits

Automatic diversification and rebalancing of your portfolio by our team of experts

DRIP - Dividend Reinvestment Program to help your investments grow faster through the power of compounding

Recurring investments make it easy so you don’t miss out when life gets busy

Fractional shares - start with as little as $5

Learn from the experts to become an expert with our award winning Money Journeys and insightful videos

Finhabits is a registered SEC investment advisor and your money is held in accounts insured up to $500K by SIPC*

*Finhabits Advisors is an SEC registered investment adviser. Registration does not imply a certain level of skill or training. Securities in your account are protected up to $500,000. See SIPC.org for more details.

Your membership goes beyond investing

As a Finhabits member you get 3 investment accounts, and you also unlock personalized financial planning, bilingual CFP access*, and tools to help you reach your goals faster.

*Available to customers with account balances over $12,000

FAQs

Yes, Finhabits is a registered investment advisor with the U.S. Securities and Exchange Commission (SEC). This registration means they are regulated as an investment advisory firm, ensuring compliance with regulatory standards. However, SEC registration does not imply a particular level of skill or training beyond regulatory requirements.

Yes. Unlike many companies, Finhabits does allow you to open an investment account with an ITIN (Individual Taxpayer Identification Number) provided by the IRS.

Finhabits offers investment accounts to match your goals: Emergency Goals for unexpected situations, invested in short-duration bond ETFs; Personal Goals for medium- to long-term growth through investments in ETFs of equities, and bonds; and Retirement Goals for long-term security, invested in ETFs of equities, bonds and REITs.

No – after you become a Finhabits member you can select up to 3 accounts to open for your various financial goals. We will guide you through the process if you’re unsure which accounts are right for you.

A Traditional IRA lets you contribute pre-tax dollars, giving you a tax break now, but you’ll pay income taxes on withdrawals in retirement. A Roth IRA is funded with after-tax dollars, so you pay taxes now, but withdrawals after age 59½ are tax-free.

At Finhabits, we invest in the U.S. stock market through diversified portfolios that include up to 6 types of assets via Exchange-Traded Funds (ETFs). These assets can include U.S. stocks, international stocks, government bonds, and real estate through REITs (Real Estate Investment Trusts).

Finhabits membership is $10/month for combined account balances under $12,000. For balances above $12,000, it automatically switches to an annual asset management fee of 1.0%.