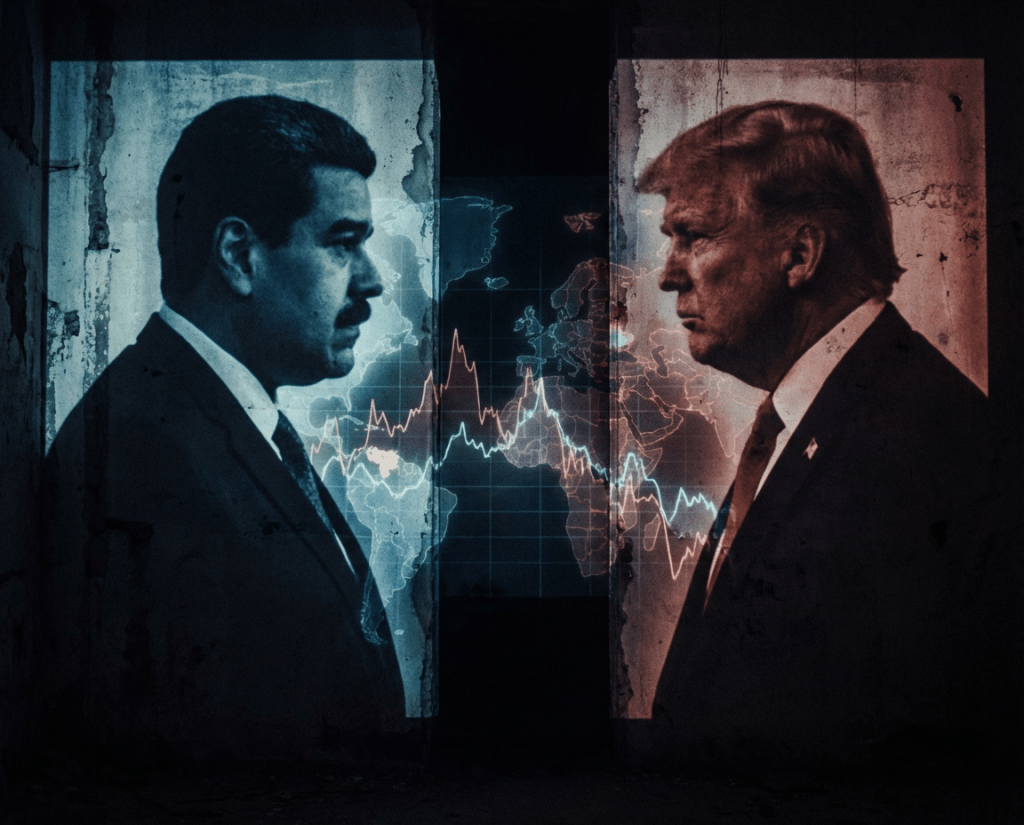

The year started with a blast—no pun intended—with the news out of Venezuela: the U.S. intervention and the capture of Nicolás Maduro and his wife, Cilia Flores. It was the kind of geopolitical shock that instantly resets the global mood, because it raises real questions about oil flows, sanctions, and what stability looks like in a region markets can’t ignore.

And yet, as the headlines intensified, markets did what they often do: they kept moving. U.S. stocks started 2026 higher through Thursday, but the picture remained layered—leadership rotated rather than surged uniformly, energy expectations stayed in focus, and U.S. data pointed to an economy cooling, not collapsing.

This week’s newsletter breaks down the most important developments—and what they may mean for everyday finances.

U.S. intervention in Venezuela resets geopolitical risk—and puts energy back in focus

The U.S. operation that captured Maduro and Cilia Flores immediately opened a new chapter of uncertainty: questions about governance, diplomatic recognition, sanctions policy, and how quickly the situation stabilizes. These are the kinds of events that markets don’t wait to “understand” before reacting—because the first thing investors price is uncertainty itself.

Venezuela’s economic relevance also isn’t theoretical. It sits close to the center of the global energy conversation, and energy is one of the fastest ways geopolitics reaches everyday inflation. Even if there is no immediate supply shock, the risk of disruption can move oil prices, and that can ripple into transportation costs, shipping, and the broader inflation narrative—especially early in the year when expectations are still being reset.

Why it matters:

When geopolitics hits an energy-linked country, the effects can travel quickly. Oil is globally priced, so it doesn’t take a confirmed supply disruption for costs to move—sometimes the “risk premium” alone is enough. And because energy touches so many parts of the economy, it can influence both household budgets and the path of inflation, which then feeds into rate expectations and borrowing costs.

What this means for your money:

This is the kind of week that tempts people into making big calls—on markets, on oil, on “what happens next.” The more practical approach is the opposite: assume volatility is possible, build a little flexibility into your spending plan, and avoid turning a fast-moving headline into a permanent change to your long-term strategy. Diversification exists for moments like this—so you don’t have to be right about one outcome to stay on track.

Stocks rose to start 2026—but the story is rotation, not clarity

U.S. equities began the year higher overall, but the market’s internal behavior has been just as important as the headline. Leadership has been shifting across sectors, and smaller companies have shown periods of outperformance—signs that investors are still debating the outlook rather than rallying behind one clean narrative.

That combination—indexes up, but leadership rotating—often shows up when markets are trying to balance multiple forces at once: geopolitical risk, policy uncertainty, and a gradual cooling in growth. It can feel like the market is sending mixed signals because, in a way, it is: risk appetite is present, but it’s selective, and it can change quickly when the next data point or headline lands.

Why it matters:

A rising market can still be a market that’s uneasy. Rotation is a signal that investors are constantly repricing “what matters most” and repositioning accordingly. That can create whiplash if you try to follow performance week to week, because the leaderboard can change fast—and the biggest mistakes often happen when people chase whatever just worked.

What this means for your money:

If the market is rotating, the goal isn’t to guess the next winning pocket—it’s to avoid being forced into that game at all. Broad diversification helps you participate across outcomes, and a long-term plan reduces the urge to make changes based on what moved this week. If you invest regularly, consistency matters even more in this kind of tape: it keeps you from turning short-term noise into long-term regret.

The jobs report cooled: about 50,000 new jobs; unemployment around 4.4%

The latest U.S. employment report showed the economy added roughly 50,000 jobs, with unemployment around 4.4%—a clear slowdown in hiring, but not a sudden break in the labor market. This is the kind of “cooling” print that keeps the soft-landing debate alive: growth may be moderating, but the foundation still looks stable enough to avoid an immediate consumer retrenchment.

At the same time, hiring momentum matters because the labor market has been a major source of household resilience. If job creation stays soft, confidence can gradually weaken and discretionary spending can slow—especially for households that feel less secure about income growth. Markets care about this for two reasons: it shapes corporate earnings expectations, and it influences the interest-rate outlook (because a cooling labor market can change how the Fed weighs inflation risks versus growth risks).

Why it matters:

Jobs are one of the most direct bridges between the economy and daily life. When hiring slows, it doesn’t automatically mean recession—but it does raise the value of preparedness. It can also change the policy conversation: a cooler labor market can support rate cuts later in the year if inflation continues to ease, but a sharper deterioration would shift the debate quickly.

What this means for your money:

This is a good moment to strengthen your “baseline resilience.” That means stress-testing your monthly budget, reducing unnecessary fixed expenses where you can, and building (or rebuilding) a cash buffer so you’re not forced into reactive decisions if conditions soften. On the investing side, the discipline is the same: avoid making big portfolio shifts based on a single report, and keep your plan anchored to a long-term horizon.

Other stories that shaped the headlines

OPEC+ held supply policy steady for Feb–Mar 2026

OPEC+ reaffirmed its near-term output stance, keeping energy markets focused on geopolitics and supply discipline as the year begins.

What it means for your money:

Energy price swings can show up quickly in gas and transportation costs, so it helps to keep a little flexibility in your monthly budget.

U.S. manufacturing remained in contraction (ISM PMI 47.9)

The ISM report showed factory activity stayed below the expansion threshold, reinforcing that parts of the economy are cooling even as markets remain resilient.

What it means for your money:

If your household budget is tight, prioritize essentials and avoid adding new fixed monthly payments until the outlook feels steadier.

Eurozone inflation cooled to around 2.0% (flash estimate)

The latest Eurozone inflation estimate came in near the ECB’s target, influencing expectations for global rate trends and currency moves.

What it means for your money:

Rate and currency shifts can affect international investments, which is one reason global diversification can help smooth outcomes.

House passed a spending package aimed at avoiding another shutdown

Congressional action reduced immediate shutdown risk, easing one source of policy uncertainty hanging over the early-year economic outlook.

What it means for your money:

Policy uncertainty can drive short-term market volatility, so it’s usually better to stick to a long-term plan than react to daily headlines.

Jobless claims remained relatively low

New unemployment claims stayed low, suggesting layoffs have not surged even as hiring slows.

What it means for your money:

A stable job market supports consumer spending, but it’s still smart to keep building your emergency fund while conditions are favorable.

Tariff authority stayed in focus via a Supreme Court dispute

A legal dispute over tariff authority kept trade policy uncertainty on the radar for businesses and markets.

What it means for your money:

Trade uncertainty can contribute to price pressure over time, especially in categories tied to imported goods.

Final thoughts

Week one delivered a clear reminder: markets can move higher even as uncertainty rises—because investors are constantly repricing what comes next. When headlines are this intense, the best approach is usually to zoom out: focus on diversification, keep a long-term perspective, and make sure day-to-day finances are resilient enough to handle short-term volatility.

If you do one practical thing this weekend, make it this: review your cash flow and identify one simple adjustment that increases flexibility—whether it’s reducing an unnecessary subscription, directing a little more to savings, or tightening a category that tends to drift.

If this week’s headlines left you feeling a little on edge, that’s normal—and it’s also a reminder that the best strategy is building habits you can control. That’s exactly what our free 12-Week Better Money Habits Challenge is for: weekly, bite-sized actions that help you reduce stress, build clarity, and stay consistent. Sign up for free and take the first step this week.

Sources

- Associated Press — What we know about a US strike that captured Venezuela’s President Nicolás Maduro and his wife, Cilia Flores

- Associated Press — How major US stock indexes fared Thursday, 1/8/2026

- U.S. Bureau of Labor Statistics (BLS) — The Employment Situation — December 2025 (PDF)

- OPEC (Official Statement) — Statement on the outcome of the virtual meeting of the eight OPEC+ countries

- Institute for Supply Management (ISM) — December 2025 ISM® Manufacturing PMI® Report

- Eurostat (European Union) — Euro area annual inflation down to 2.0% (flash estimate)

- Associated Press — House passes spending bills as lawmakers work to avoid another shutdown

- U.S. Department of Labor (ETA)— Unemployment Insurance Weekly Claims Report (PDF)

- The Wall Street Journal — U.S. Customs Ditches Paper Checks as Importers Await Tariff Refund Decision

Disclaimer:

This material is provided for informational purposes only and is not intended to offer investment, legal, or tax advice. All images and figures are for illustrative purposes. Investment advisory services are offered through Finhabits Advisors LLC, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. Past performance is not indicative of future returns. All investments involve risk, including the possible loss of principal. Securities are offered through Apex Clearing Corporation, Member of FINRA, SIPC. Securities held at Apex are protected up to $500,000, which includes a $250,000 cash limit. See SIPC.org for more details.

© Finhabits, Inc. All rights reserved.